Rating: 5. Reviewer: Student Loans Guide - Item Reviewed: Student Loans - Support by: Student Loans Guide. Student Loans Guide will guide you to get a student loans for college or career school are an investment in your future by borrow in federal student loans or any student loans sources.

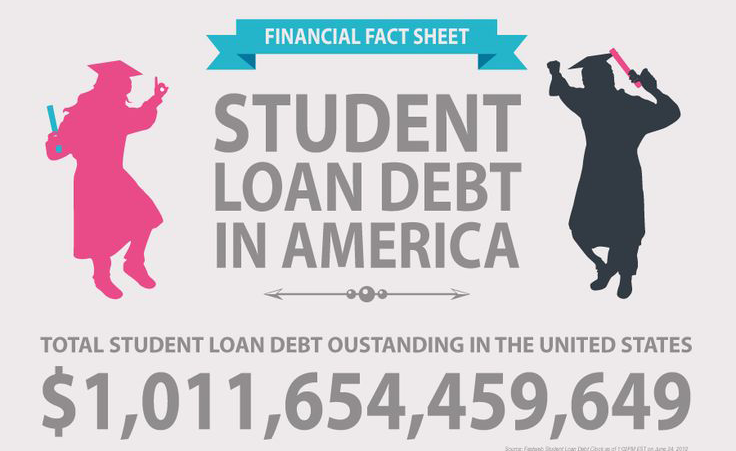

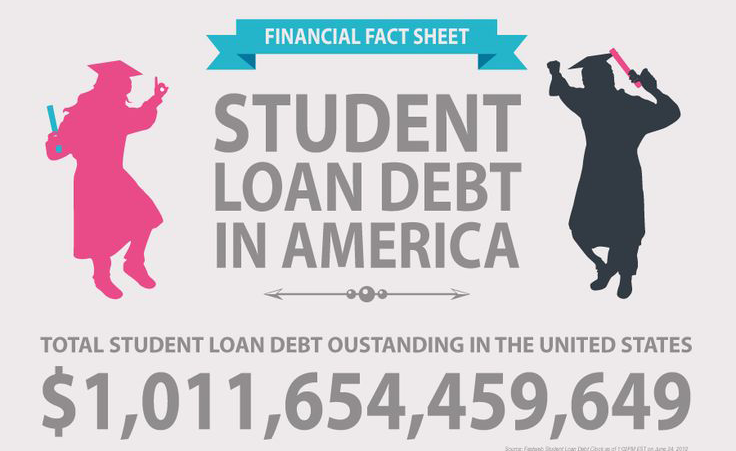

Student Loans. Everyone wants to go to college debt-free, but unfortunately student loans are inevitable. Student loan payable is a consequence of attending lectures but can be managed. Make the process of paying school less painful by learning the different types of student loans available. Student loans are divided into two categories, federal and private. Federal loans are available to students and parents, and have uniform levels and requirements. The most common federal loans are Stafford Loans, Perkins Loans, and PLUS Loans. Private student loans are borrowed from lending institutions, with credit terms, interest rates, and repayment schedules set by the lenders. To choose the best one for you, check out all your options:

Stafford Loans comes in two flavors: subsidized and unsubsidized. With subsidized loans, interest does not begin to grow until you leave school - the federal government pays interest when you go to school. With unsubsidized loans, you are responsible for the interest that arises during your college years. Unsubsidized loans are open to anyone, regardless of need, but subsidized loans are only offered to students who demonstrate financial needs. Many students combine subsidized and unsubsidized borrowing to achieve the maximum allowed amount each year.

Recognize your options before signing a loan agreement, and ask your financial aid officer about additional fees and disbursement procedures. Also, remember you must submit Free Free App for Federal Student Aid (FAFSA) every year.

Student loans can really help, but make sure you understand your loan terms before you enter. Ease your burden later by understanding your loan program now.

Stafford Loans

Stafford Loans is a low-interest loan, which is awarded to students under a federal loan program. The idea is to provide loan options for students who may not be able to take out a loan with a private lender because of insufficient credit history.Stafford Loans comes in two flavors: subsidized and unsubsidized. With subsidized loans, interest does not begin to grow until you leave school - the federal government pays interest when you go to school. With unsubsidized loans, you are responsible for the interest that arises during your college years. Unsubsidized loans are open to anyone, regardless of need, but subsidized loans are only offered to students who demonstrate financial needs. Many students combine subsidized and unsubsidized borrowing to achieve the maximum allowed amount each year.

- Who is eligible: Dependent or independent undergraduate or graduate students indicating financial (subsidized) or not (not subsidized) needs.

- How to apply: Get a FAFSA.

- Maximum you can get: Dependent undergrads can borrow up to $ 5,500 in the first year, $ 6,500 in the second year, and $ 7,500 each year. Self-employed students can borrow an additional $ 4,000 that is not subsidized for the first two years and the remaining $ 5,000. Generally, graduate students can borrow $ 20,500 per year. The cumulative max for undergrad and grad is $ 57,500 in subsidized loans and $ 138,500 for subsidized and unsubsidized combined.

PLUS Loans

PLUS Loans are low interest loans available for parents to cover their children's education expenses. Like Stafford Loans, PLUS Loan is managed by the federal government. PLUS loans are the responsibility of parents, not students.- Who is eligible: Parents of dependent undergraduate students. Borrowers generally have to pass credit checks, but if not, they can prove mitigating circumstances or ask a friend or relative to approve the loan.

- How to apply: Send FAFSA.

- Maximum you can get: As much as necessary to cover the tuition fees that have not been covered by other financial assistance.

Perkins Loans

Perkins Loans is a special class of federal loans intended to provide additional assistance to students with extreme financial needs. They are subsidized, long-term and low-interest loans. These loans are made with a combined grant from your government and school.- Who is eligible: Undergraduate and graduate students / professionals who exhibit outstanding financial needs.

- How to apply: Get a FAFSA.

- Maximum you can get: Undergrads may receive $ 5,500 per year, for an amount not more than $ 27,500. Graduate students can receive $ 8,000 per year, for a cumulative (undergrad plus grad schools) maximum of $ 60,000.

Consolidated Loans

Consolidation Loans incorporate one or more federal loans into one new Direct Loan from a single lender. Consolidated loans often reduce the amount of your monthly payments by extending your loan term. Additional benefits may include more flexible repayment options and only one monthly bill. However, the payback period is often extended, which means that you may be paying more interest during that period.- Who is eligible: Anyone eligible for federal or direct loans

- How to register: Complete the application online. You should also check with your lender on how to register.

- Maximum you can get: Depends on your financial needs.

Personal / Alternative Loans

In addition to federally sponsored loans, students can borrow money for lectures from private banks and lenders. These loans can help cover the cost of education beyond the limits of government borrowing.- Who is eligible: Independent students and dependent parents who meet the criteria of private institutions.

- How to apply: Through private lenders.

- Maximum you can get: Depends on the cost of education.

Recognize your options before signing a loan agreement, and ask your financial aid officer about additional fees and disbursement procedures. Also, remember you must submit Free Free App for Federal Student Aid (FAFSA) every year.

Student loans can really help, but make sure you understand your loan terms before you enter. Ease your burden later by understanding your loan program now.

0 Response to "Student Loans"

Post a Comment