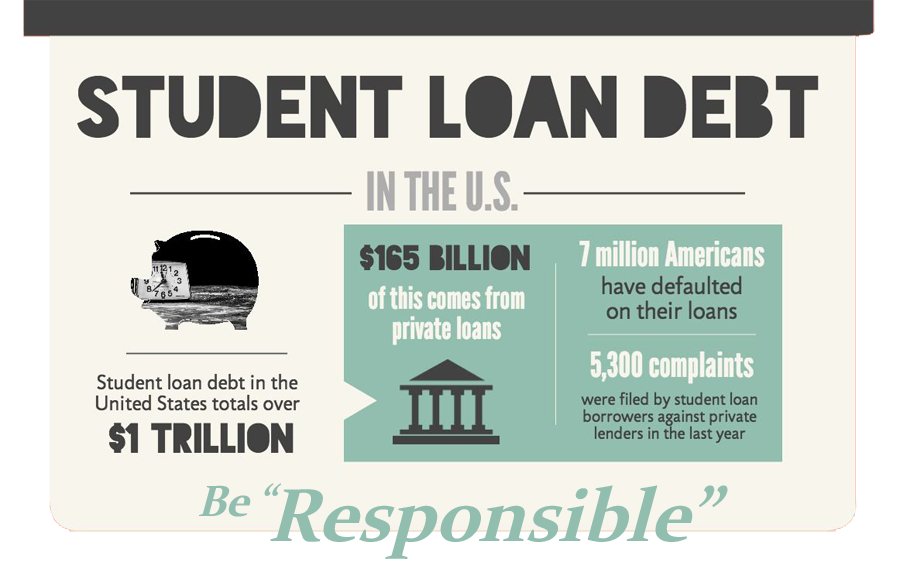

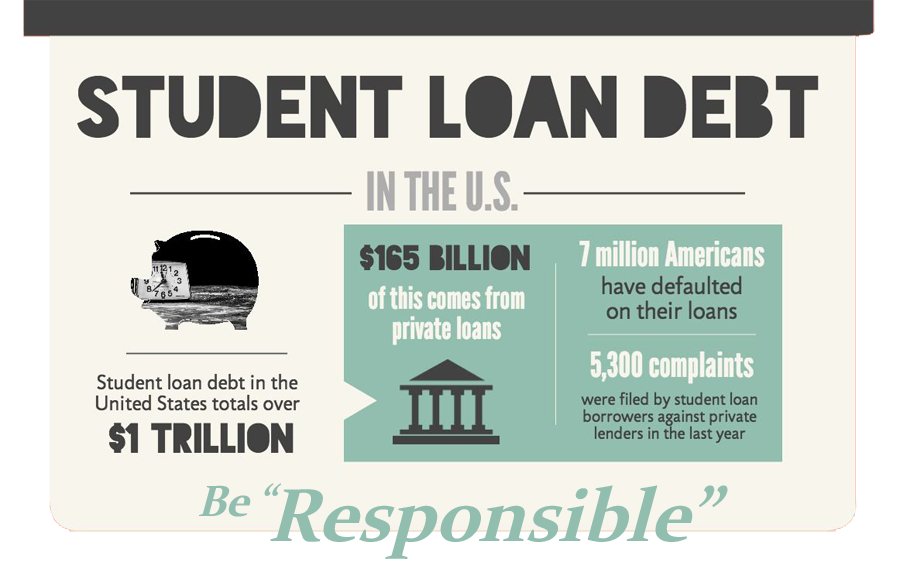

Rating: 5. Reviewer: Student Loans Guide - Item Reviewed: Be A Responsible Borrowers - Support by: Student Loans Guide. Student Loans Guide will guide you to get a student loans for college or career school are an investment in your future by borrow in federal student loans or any student loans sources.

Be A Responsible Borrowers. What should I consider when taking a federal student loan? Before you take out a loan, it is important to understand that a loan is a legal obligation that you will be liable to pay back with interest. You may not need to immediately repay your federal student loans, but you do not have to wait to understand your responsibilities as a borrower. Get scoop: Watch this video about a responsible loan or search for a tip below it.

- Note how much you borrow. Think about how your loan amount will affect your future finances, and how much you can afford to pay back. Your student loan payment should be just a fraction of your salary after you graduate, so it's important not to borrow more than you need for your school fees.

- Research starts salary in your field. Ask your school to start a recent graduate salary in your field of study to get an idea of how much you earn after you graduate. You can use the Outlook Occupational Outlook Handbook from the U.S. to estimate the salary for various research career or research opportunities advertised in the area where you plan to live to get an idea of the initial local salary. You can also use the Department of Labor's career search tool to research careers and see the average annual salary for each career.

- Understand your loan terms and keep a copy of your loan documents. When you sign your promissory note, you agree to pay off the loan in accordance with the record requirements even though you have not completed your education, can not complete the job after completing your program, or you do not like the education you receive

- Make timely payments. You are required to make payments on time even if you do not receive a bill, payment notification, or reminder. You have to pay the full amount demanded by your repayment plan, as some payments do not meet your obligation to pay off your student loan on time.

- Keep in touch with your loan servicer. Notify your loan officer when you graduate; withdraw from school; drop below half time status; transfer to another school; or change your name, address, or Social Security number. You should also contact your servicer if you have difficulty making your scheduled loan payment. Your maid has several options available to help you keep your loan well.

How to get a federal student loan?

To apply for a federal student loan, you must complete and submit a Free Application for Federal Student Aid (FAFSA®). Based on your FAFSA results, your college or career school will provide you with an offer of financial assistance, which may include federal student loans. Your school will tell you how to accept all or part of the loan.

Before you receive your loan fund, you will be required

- Entirely incoming entry, a tool to ensure you understand your obligation to pay off the loan; and

- Signed Master Promissory Note (MPN), agreed to terms of the loan.

Contact the financial aid office at the school you are going to visit for details about the process at your school.

0 Response to "Be A Responsible Borrowers"

Post a Comment